In the digital age customer service is everything because if you cannot satisfy your customers somebody else will do irrespective of whether you are selling insurance policies or a bottle of red wine.

Now, when the concern is about insurance industries customer satisfaction is something that cannot be ignored. Whether the concern is about issuing a policy or it is about claiming an insurance policy. So, every customer interaction has a huge role to play in this domain.

So, what is telematics, and how it can help auto insurance companies improve customer engagement?

Is your auto insurance company really in need of telematics solutions? You will soon find out in this blog.

What is telematics in auto insurance?

Traditionally, various factors, including the make and model of your car, have played a role in determining the cost of your auto insurance policy. When two individuals own identical vehicles, their insurance rates typically align. However, what happens if one of these drivers is notably safer? Should they be subject to the same premiums? This is where usage-based or telematics-based auto insurance coverage comes into play.

Telematics devices, seamlessly integrated into vehicles, serve the purpose of monitoring associated risks, a concept widely embraced by the insurance industry under the term “Usage Based Insurance.” These devices meticulously record drivers’ habits, encompassing daily mileage, average speed, and the overall safety level exhibited while operating the vehicle.

These data sets are then leveraged to calculate personalized motor insurance rates, tailoring costs to the specific risk profile of each vehicle. For instance, a car that frequently travels at high speeds on highways may incur a higher insurance rate compared to one driven at moderate speeds within a city.

Telematics not only enhances affordability for those who adopt safer driving practices and cover fewer miles but also enables insurance companies to accurately assess accident losses and reduce the incidence of fraudulent claims. The implementation of telematics technology in businesses is a crucial aspect, ensuring fair pricing for auto insurance customers. But how exactly do companies integrate and utilize telematics technology?

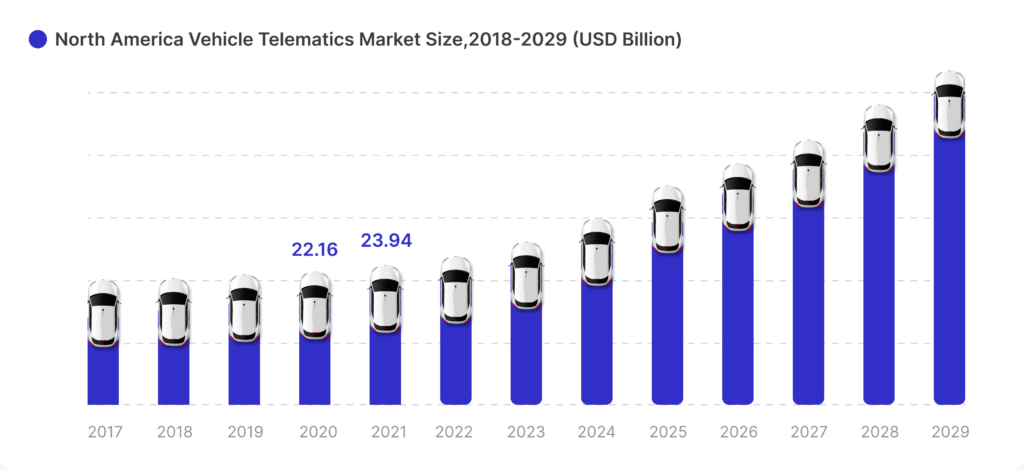

According to Allied Market Research, the telematics insurance market is experiencing robust growth, projected to reach $13.78 billion by 2030 at a notable Compound Annual Growth Rate (CAGR) of 19.5%.

Applications of telematics in insurance

Accurate risk assessment & pricing

Insurance telematics offers insurers a comprehensive and real-time overview of individual driving behaviors, facilitating a more precise evaluation of risk. Monitoring factors such as speed, acceleration, braking, and location enables insurers to customize premiums based on each driver’s specific behavior, mitigating the risk of undercharging or overcharging policyholders and ensuring equitable pricing.

Reduced claim leakage

The integration of telematics in the insurance industry actively promotes safer driving practices, resulting in a direct reduction of accidents and claims. Encouraging safer behavior through the prospect of lower premiums, drivers are incentivized to avoid aggressive driving, speeding, and abrupt braking. This, in turn, leads to a decrease in accidents, lowering claims payouts and minimizing overall losses for insurance companies.

Increased customer satisfaction rate

Telematics facilitates ongoing communication between insurers and policyholders by offering regular feedback on driving habits, personalized safety tips, and potential premium discounts. This proactive engagement not only boosts customer satisfaction but also fosters brand loyalty, contributing to sustained customer retention in the long term.

Fraud detection & prevention

The utilization of telematics data serves as a potent tool for identifying and preventing fraudulent claims. By cross-referencing telematics data with claim details, insurers can spot inconsistencies and take action against fraudulent activities, ultimately reducing financial losses.

Enhancing overall operational efficiency

Efficiently streamlining the claims process, telematics provides accurate and real-time accident data, enabling insurers to reconstruct accident scenarios with precision. This reduces the need for prolonged investigations, accelerating claims settlement, enhancing customer satisfaction, and cutting down on administrative costs.

Make informed-decisions

The abundance of telematics data empowers insurers to make informed, data-driven decisions. Analytics derived from this wealth of data offer valuable insights into market trends, customer behavior, and risk patterns. These insights guide underwriting strategies, inform product development, and support business expansion, ensuring insurers remain competitive in a dynamically evolving industry.

Benefits of telematics in auto insurance

1. Precision in premiums

Utilizing data from insurance telematics enables insurance providers to set premiums and policies with greater accuracy, ensuring they align closely with the actual risk associated with insuring their customers. This precise pricing forms the cornerstone of financially sound business operations and helps maintain stable rates, preventing significant fluctuations that could lead to customer attrition.

2. Risk mitigation

Insurance telematics facilitates the collection of extensive data, allowing providers to develop more sophisticated risk models and effectively reduce their overall exposure to risk. This empowers insurers to confidently manage higher-risk situations, secure in the knowledge that the premiums adequately cover the associated exposures.

3. Enhanced decision-making speed and precision

The integration of insurance telematics data into core systems, including policy administration, actuarial and underwriting, billing and claims, as well as interactive policyholder portals, enables quicker and more predictive decision-making. Real-time insights garnered from telematics data contribute to more informed and efficient decision processes across various aspects of insurance operations.

4. Operational efficiency

Insurance telematics facilitates the automation of processes with accurate geospatial and vehicle data, streamlining or eliminating manual and time-consuming tasks. This increased efficiency not only reduces the likelihood of errors but also optimizes resource utilization, contributing to a more streamlined and effective insurance operation.

5. Innovative product offerings

Telematics in insurance supports the development of new and innovative products, particularly in the realm of usage-based insurance programs. These programs, such as pay-as-you-drive (PAYD), incentivize customers with discounts based on their safe driving behavior. The incorporation of insurance telematics allows insurers to explore and implement these novel offerings, aligning with the preferences of an increasingly receptive customer base.

How AgiraSure’s Accelerators can help

AgiraSure’s telematics solution transforms auto insurance with advanced data capture, offering real-time insights into driving behaviors. This technical innovation enables precise risk assessment by monitoring speed, acceleration, braking, and location. Integrated seamlessly into core insurance systems, our telematics streamlines operations in policy administration, underwriting, and claims processing. This not only ensures fair pricing based on accurate data but also enhances risk management, setting a new standard for operational efficiency in the insurance sector.

Wrapping up

In conclusion, the integration of telematics in the auto insurance industry marks a significant leap forward in creating a more dynamic and customer-centric landscape. With a focus on precision in pricing, risk mitigation, and operational efficiency, telematics, exemplified by AgiraSure’s advanced solution, reshapes how insurance companies interact with and serve their policyholders. The benefits, ranging from fair and accurate premiums to streamlined claims processing, underscore the transformative impact of technology in fostering safer driving habits and ensuring a responsive, data-driven approach to insurance operations. As we navigate the evolving insurance landscape, telematics stands out as a pivotal force driving innovation, efficiency, and a more personalized insurance experience.