Catastrophe claims processing is a critical frontier where accuracy, efficiency, and empathy converge in the dynamic world of insurance. The challenges in this field have changed as 2024 approaches, necessitating creative ways to improve policyholder support during difficult times and streamline the process.

The growing complexity

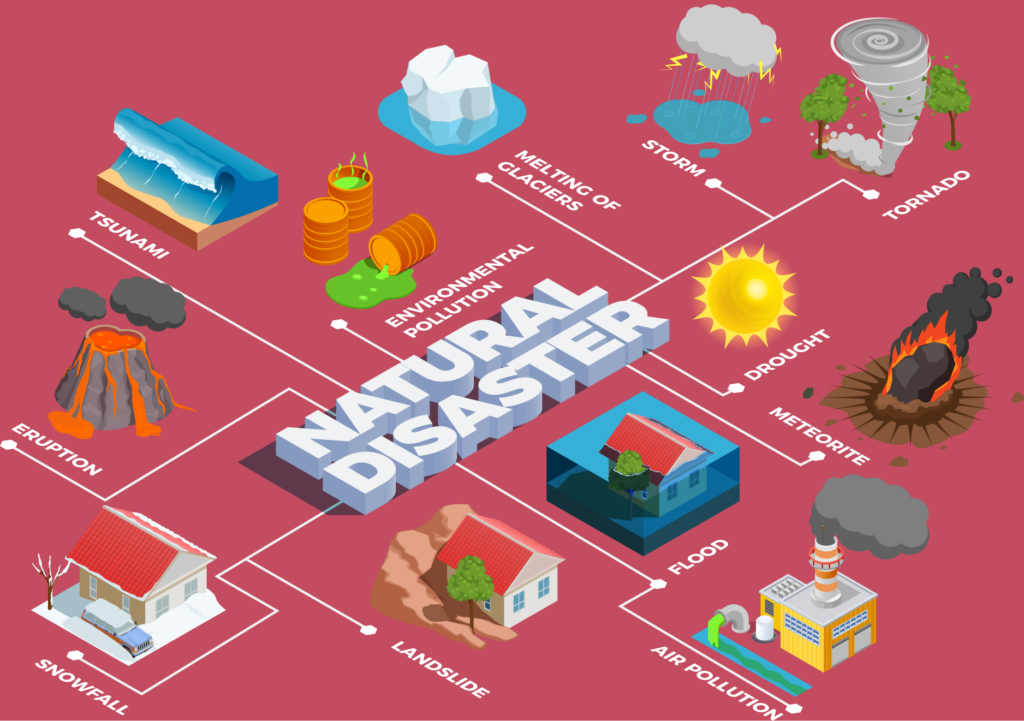

There has been an increase in catastrophe claims, which are frequently brought on by natural calamities like hurricanes, earthquakes, or wildfires. According to the Insurance Information Institute, catastrophic losses have increased by 10% annually, illustrating how the effects of climate change are being felt around the globe. As these occurrences grow in frequency and severity, the insurance sector needs to adjust to the rising complexity of handling claims.

Data deluge

The massive amount of data that insurers encounter during catastrophic occurrences is one of their biggest challenges. The amount of data accessible to evaluate claims has increased dramatically with the spread of smart devices and the incorporation of IoT in residences and commercial spaces. The difficulty in 2024 will be not only gathering data but also sifting through the massive amount of data to find relevant insights.

The value of technology

Insurance companies are using cutting-edge technology like machine learning and artificial intelligence to tackle this problem. These technologies can quickly process claims, find patterns within large datasets, and sort through them. Through technology, insurers can improve accuracy, shorten processing times, and help policyholders more quickly when needed.

Human touch in digital transformation

Even though technology is very important, processing claims requires a human touch that cannot be overlooked. Policyholders who experience tragic occurrences require compassion and understanding. The combination of human compassion and technical tools guarantees a fair and efficient claims processing procedure. Embracing technology and smoothly integrating it into a framework that is focused on the consumer is not enough in 2024.

Streamlining communication

Effective communication is the foundation of successful catastrophic claims handling. Policyholders are frequently concerned and in need of fast updates. Insurers must invest in improved communication channels to ensure that information flows easily between the firm and the policyholder. This not only lessens anxiety but also promotes trust and loyalty.

Regulatory compliance

Staying compliant in the ever-changing environment of insurance rules is a daily challenge. Compliance with regulatory regulations ensures that claims are processed in a transparent and ethical manner. Insurers must invest in resilient technologies that can adapt to regulatory changes, ensuring a secure and compliant environment for claims processing.

The Role of Insurtech

Insurtech firms are emerging as significant stakeholders in the transformation of catastrophic claims processing. These firms are transforming the industry with new solutions ranging from blockchain for safe data management to parametric insurance for quick claim settlements. Traditional insurers may improve their agility and reactivity in the case of disasters by cooperating with insurtech.

Customer education

Insurers must not only handle claims swiftly, but also educate clients about their coverage and the claims procedure. A lack of understanding can cause delays and difficulties at an already stressful moment. To empower consumers and shorten the claims experience, insurers must invest in clear communication and instructional materials.

Balancing speed and accuracy

The age-old conundrum of speed vs accuracy remains a concern in catastrophe claims processing. While accelerated claims processing is critical for giving timely relief, accuracy should never be compromised. Finding the appropriate balance necessitates the seamless blending of technology, human knowledge, and simplified procedures.

Conclusion

The key to navigating the obstacles of catastrophic claims processing is a comprehensive strategy that blends smart technology with a human touch. The insurance sector must continue to change, embracing innovation while keeping customers’ needs and emotions in mind. By tackling these issues front-on, insurers may not only simplify claims processing but also strengthen their value offer as dependable partners in times of crisis.